- 141 South Main Street, Suite# LT, Clayton, GA 30525

- 706-212-0228

- laketeam@icloud.com

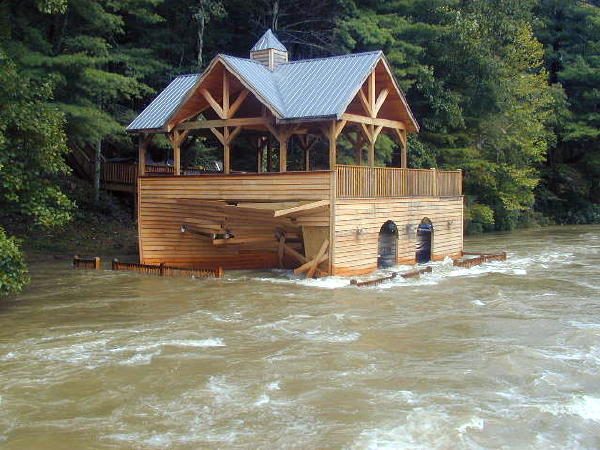

Flood insurance is something most of use do not have but wished we did if we ever need it. In fact, nationwide, only about 20% of homes at risk are covered by this specialized insurance. Your homeowners insurance generally will not compensate you if your property is damaged or destroyed by flood originating outside the home. The lack of flood insurance can be detrimental to homeowners who discover only after the damage has been done that their standard insurance policies do not cover flooding. Did you know it only takes 1 inch of water in home to cause over $20,000 in damage? Or that it takes just 6 inches of moving water to topple an adult and 12 inches to sweep away a small car? Water can be powerful and damaging. While your property on Lake Rabun, Lake Burton, or Seed Lake may not appear to be a risk, keep in mind extreme weather brings about most floods.

In designated flood hazard and flood prone areas the federal government requires flood insurance to secure mortgage loans backed by federal agencies such as FHA and VA. Private lenders may also require coverage to protect their collateral. How do you know if you’re at risk for a flood? FEMA (Federal Emergency Management Agency) updates their flood maps yearly (they are called “Flood Insurance Rate Maps” or “FIRMS”) to provide each community a designated risk category. Lenders rely on these maps to determine if you will require flood insurance for your loan. https://msc.fema.gov/portal/home and http://map.georgiadfirm.com are two good sources to determine if your property is in a flood zone.

Generally there are 2 types of food insurance- one through FEMA and the other through a private insurer. If your property is in a community served by the National Flood Insurance Program (NFIP) you can protect both your home and its contents. The cost for coverage varies depending on the value of possessions and the location of the property relative to high or low risk areas identified on the rate maps.

Often a property will be determined to be within a flood hazard area where in fact it is on higher ground and not at high risk. A Letter Of Map Amendment (or LOMA) establishes a properties location relative to the flood hazard area. A LOMA officially amends the maps and becomes a matter of public record in the community that has been amended.

Comments are closed here.